Etango Project

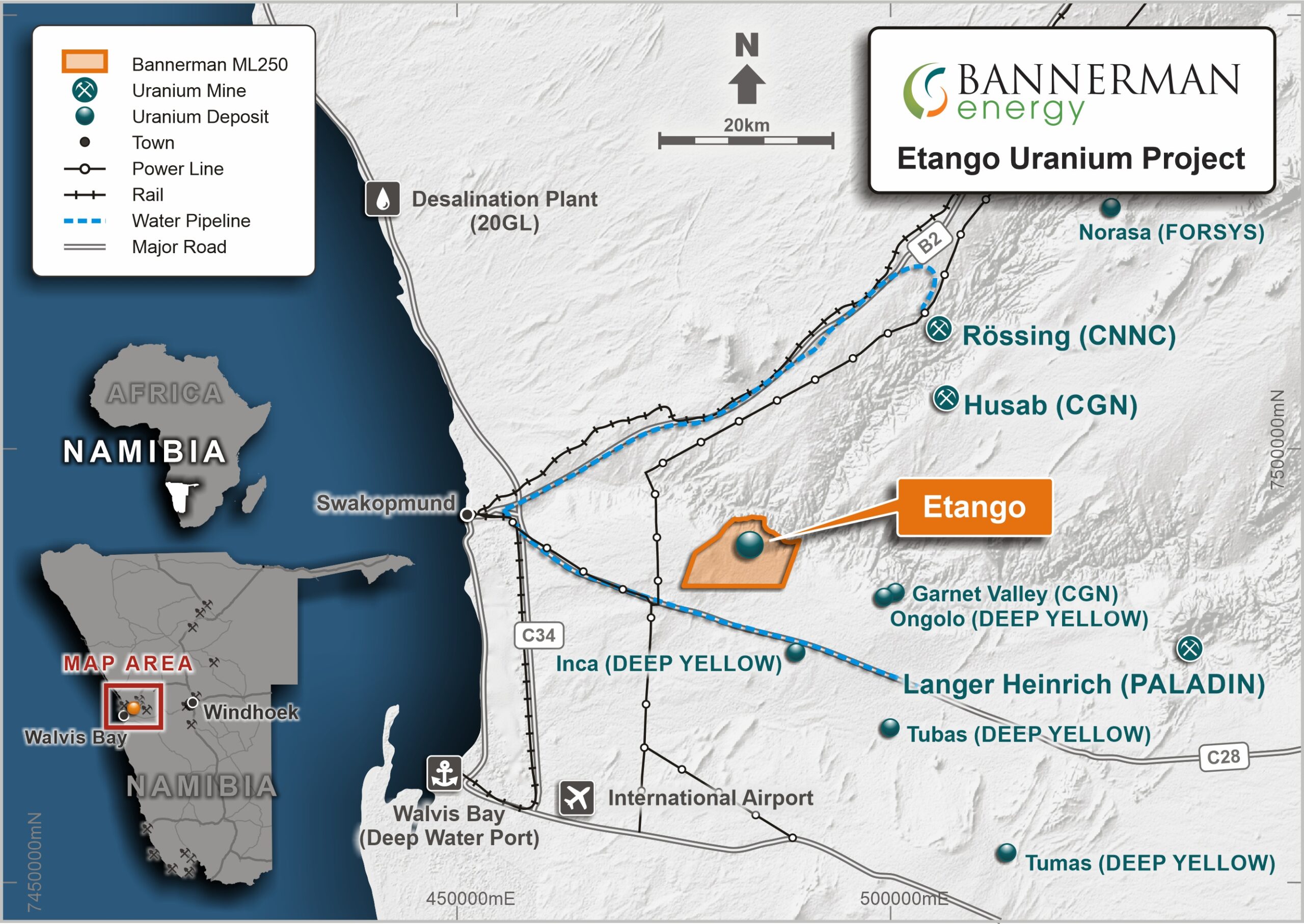

The Etango Uranium Project is located in the Erongo Region of Namibia, 30 kilometres south-east of Swakopmund. It possesses a World class uranium Mineral Resource endowment of 207 Mlbs of contained U3O8 (100ppm U308 cut-off).

Etango has benefited from extensive exploration and feasibility activity over the past 15 years. This includes detailed feasibility work on a large-scale development of Etango that culminated in the 2012 Definitive Feasibility Study (DFS 2012) and 2015 DFS Optimisation Study (OS 2015). As part of these processes, we obtained environmental permitting for the proposed Etango mine (2012) and all associated external infrastructure (2014).

In 2015, we completed construction of the Etango Heap Leach Demonstration Plant, which ran as a pilot plant until 2020. The operation of the Demonstration Plant comprehensively de-risked the proposed heap leaching processing method for Etango, allowed optimisation of processing parameters and generated a large database of processing data.

In August 2020, we completed a Scoping Study on development of Etango at an 8Mtpa throughput rate. The Etango (8Mtpa) Scoping Study was heavily informed by the detailed study work undertaken across all relevant disciplines as part of the Etango (20Mtpa) DFS 2012 and the OS 2015, and operation of the Heap Leach Demonstration Plant. The Scoping Study demonstrated that this accelerated, streamlined project was strongly amenable to development – both technically and economically.

In August 2021, we completed a Pre-Feasibility Study (PFS) on Etango at 8Mtpa. The PFS confirmed the strong technical and economic viability of conventional open pit mining and heap leach processing of the world-class Etango deposit at 8Mtpa throughput. The level of planning rigour for Etango was bolstered through the PFS process via the inclusion of dual pit ramps in the northern and central pits, detailed plant design and higher accuracy estimation.

In December 2022, we completed the Definitive Feasibility Study (DFS) on Etango at 8Mtpa. The DFS on Etango (8Mtpa) is a study of world-class quality, with input from leading experts across each facet of mining uranium in Namibia. Critically, the DFS confirmed, to a definitive level, the robust overall viability of development and operation of the Etango (8Mtpa) Project.

To learn more about the key physical and financial outcomes of the Etango (8Mtpa) Definitive Feasibility Study, click here.

The Etango Mining Licence application was granted in December 2023. This key milestone was followed swiftly by the commencement of early development works at Etango. Bannerman has awarded two contracts to local Namibian businesses for the construction of a temporary water pipeline and access road.

Front End Engineering and Design (FEED) studies for Etango are well progressed in parallel with advancing offtake and project finance workstreams. These activities are steadily culminating in a push towards a positive Final Investment Decision (FID) for Etango, market conditions permitting, targeted during 2024.

To reinforce the technical and commercial viability of subsequent expansion, following construction and ramp-up at Etango, Bannerman completed a Scoping Study in February 2024 outlining two future-phase development options: an expansion of mine and plant throughput to 16Mtpa (Etango-XP) and a life-of-mine extension with mine and plant throughput maintained at 8Mtpa (Etango-XT).

The Etango-XP/XT Scoping Study produced robust financial metrics showing the substantial in-ground leverage and scalability of the world-class Etango resource to higher uranium price outcomes. For further details about the key physical and financial outcomes of the Etango-XP/XT Scoping Study, click here.

Highly robust technical parameters AND STRONG PROJECTED ECONOMICS

15+ years

Initial mine life

8 Mtpa

Throughput capacity

87.8%

Processing yield

52.6 Mlb U3O8

Total production

17%

Post-tax IRR

US$209M

Post-tax NPV8%

US$317M

Pre-production capital expenditure

US$38.1/lb

All-in-sustaining-cost (AISC) U3O8

Namibia

Namibia is a premier operational uranium jurisdiction with a 45-year history of safe uranium production and export. It possesses excellent utilities, transport and export infrastructure as well as established support for uranium mining from both government and community.

As the world’s third largest producer of uranium, Namibia is an ideal jurisdiction in which to advance a world-class uranium project given its attractive combination of political stability, security, a strong rule of law and an assertive development agenda.

Location and Infrastructure

The C28 road from Swakopmund passes approximately 10km to the south of Etango, with planned construction of a spur road to site, parallel to the power line and water pipeline services route.

Power is to be sourced from the grid, via a planned 29km, 132kV line from the Kuiseb substation. Significant upgrades to the power generation capacity and distribution infrastructure have been undertaken by NamPower (national utility) over the last 5 years.

Water is to be sourced from NamWater, the national water utility company, with the planned pipeline and pumping route from NamWater’s Base Reservoir in Swakopmund.

The port of Walvis Bay is a highly established uranium export facility that has been handling Class 7 cargo for over 40 years. It has controlled areas within the facility specifically designated for uranium export, which Bannerman plans to utilise.

Early development works have commenced for the construction of a temporary water pipeline and access road. The temporary pipeline will ensure sufficient water is available onsite when main earthworks and civil contracts commence. The access road will enable controlled access to the mine site and ensures minimal impact on the surrounding area.

These early works precede the commencement of full construction works, which are to begin upon a positive Financial Investment Decision (FID) for Etango, which is targeted to occur in 2024.